The case for financial literacy

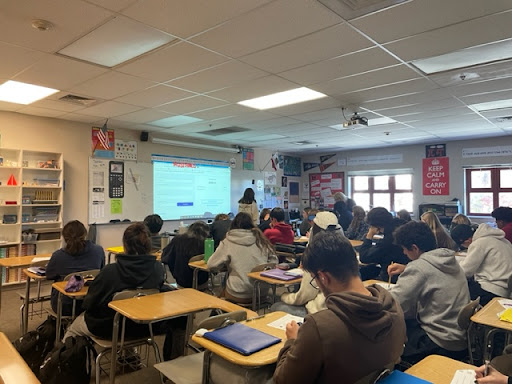

Monte Vista students studying during a personal finance class lecture. Students and teachers put an emphasis on the importance of this class primarily for Juniors and Seniors navigating how to manage their finances, or those simply intrigued to learn more about the topic.

When it comes to some of the main principles of financial literacy such as budgeting, saving, investing, and spending, the skill level that people have in grasping these concepts will remain necessary throughout their whole life. Personal finance isn’t taught in most schools. In fact, some schools don’t prioritize or provide personal finance education whatsoever.

Regardless of the field that students choose to go into after high school, financial education is crucial for people to successfully manage their daily living expenses and manage their resources wisely to create a stable, financial well- being.

Former President Bill Clinton preached on this topic at the “World’s Largest Financial Literacy Education Event ‘‘ at University Of Southern California’s basketball arena on November 9th, 2014. Clinton explained that financial literacy is “a very fancy term for saying spend it smart, don’t blow it, save what you can and know how the economy works.”

He emphasized how many schools don’t do a great job presenting the main principles of financial literacy, and therefore millions of Americans lack basic financial knowledge that they should carry with them throughout their lives.

“If you want to be powerful, if you want to live your dreams, if you want to get an education and make the most of it, [then] you’ve got to know how to handle your money,” Clinton said.

The curriculum covered in a personal finance course ranges from financial math and stocks to paying for college and getting a job. These crucial concepts, along with many more are incorporated into a year long course.

Currently at Monte Vista High School one personal finance course is offered with a total of 99 students total enrolled in the course this year.

“I would say that everybody should be educated [about personal finance], not just high school students,” Monte Vista math teacher Aimee Kerr said. High school is the perfect time to do it though because many students are about ready to go off to college or maybe start working. When it comes to the topic of financial literacy, people tend to slip into common pitfalls because they lack the proper education on how to handle their finances. For example, establishing credit history, and understanding what a strong credit score is are some of the many fundamental topics covered in a personal finance course.

“[One of the] easy pitfalls is getting a credit card and [not knowing] how to pay it back in full every month,” Kerr said.

This can become a major issue for many because having a high balance on your credit card means that each month you don’t pay your balance in full, your finance charges will start to increase in the form of interest.

When it comes to taking a personal finance course, you can get a lot of helpful information that can put you in a position to be more proactive than others. One of the major beneficial impacts of this course is that it teaches you discipline with saving consistently. Looking at your finances can become much easier if you know how to responsibly and actively manage them.

Although there are still ways that you can develop the knowledge overtime to properly manage your finances, the benefits of taking the class truly sets you up for success. Without taking any classes, many people can become more prone to financial stress during their lives which can in turn affect their mental health and wellbeing.

“If you talk to parents or older people, [many] have learned [how to manage their finances] through trial and error,” Kerr said.

Life gets more complicated if you plan to buy a house, start a family, or invest. These are some examples of larger financial commitments. So it’s crucial to be wise about your spending habits early on. Personal experience teaches people the do’s and don’ts of managing their money. The more you can absorb through life experiences, the more you will learn and grow to feel financially comfortable and lower financial stressors that come with adulthood.

However, personal finance classes still remain as the foundation for young kids and teens to learn so that in the future they know how to avoid debt and be smart enough to refrain from unmanageable spending habits that can develop. That is why in many ways it is viewed as a necessary class for many high school students. In a personal finance class students encounter topics that they soon will apply in real life situations that they have possibly already encountered in their life.

“I think this class should be a requirement for all high schoolers personally because it’s really informative. It’s the most useful and interesting math class I’ve ever taken, [considering] I have already applied [topics] I’ve learned in this class to real life. Which I have never really done before,” Monte Vista senior James Carney said.

Taking a personal finance course becomes especially important for seniors who are just about to go to college and deal with real life applicable situations such as student loans and filing taxes. Students who have a job in high school or plan to get a job soon should also be aware of how to manage their finances so that they can potentially save up for college.

“A good [tip] that has helped me is don’t treat your whole paycheck as just spending money; take at least half of it and put it away in your savings account and make that a habit,” Carney said.

The goal of a personal finance class isn’t to promote not spending any money; rather it is designed to make students aware when they shouldn’t spend money in order to have low risk steady investments and have financial stability.

Maraki Amare is a senior at Monte Vista. This will be her fourth year as a part of the Journalism Staff....

Scott Guild • Dec 19, 2022 at 12:31 pm

Providing “real world” examples and experiences relative to why should I learn math is a very powerful and effective instructional tool. Integrating personal finance content into a math class makes it more interesting and relevant. IMO